U.S. Housing Affordability Remains at Historic Lows

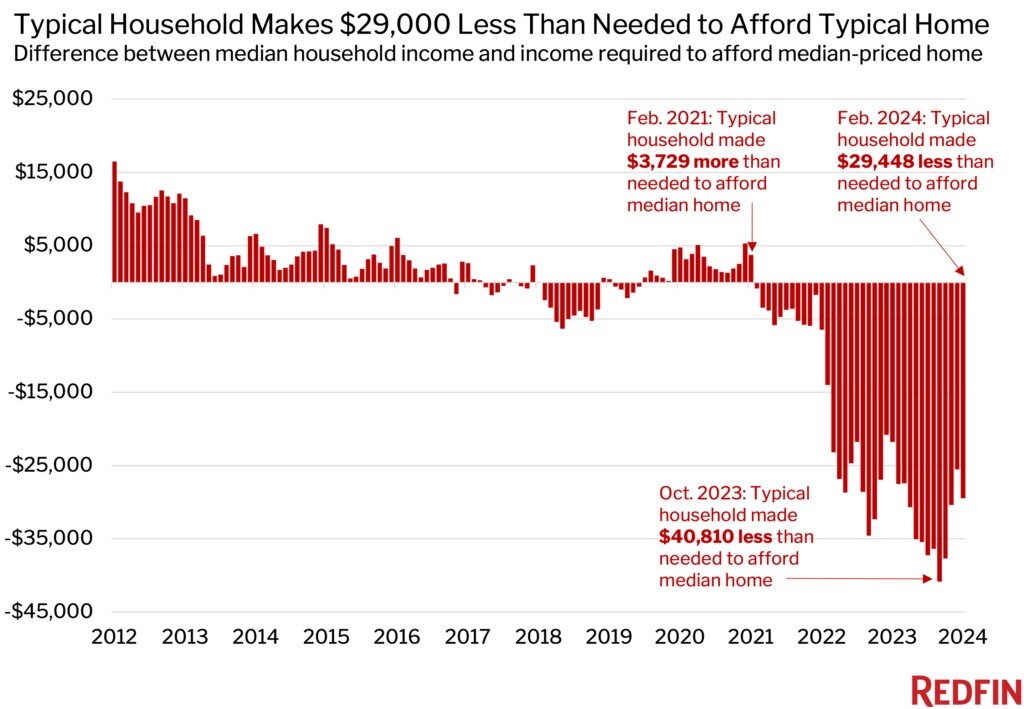

According to national property broker Redfin, the typical U.S. household earns $29,448 less than it needs to afford the median-priced home in 2024.

While that’s a sign of a major housing affordability crisis, it marks an improvement from October, when the typical household earned a record $40,810 less than it needed as mortgage rates hit the highest level in 23 years.

That’s based on a Redfin analysis of the estimated median U.S. household income and median monthly housing payments as of February 2024.

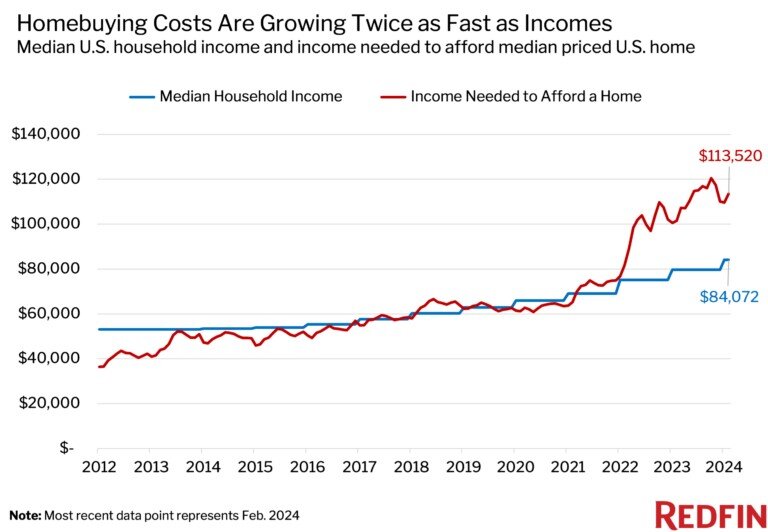

Buyers needed to earn an annual income of $113,520 to afford the median-priced U.S. home in February ($412,778). That’s 35% more than the $84,072 median household income.

In October, when the mismatch between median income and the income needed to afford a home was highest, homebuyers needed to earn $120,500 to afford the typical home. That was a record 51% more than the $79,689 earned by the typical household.

February 2021 was the last month on record when the typical household earned more than it needed to afford the median priced home. Back then, the median household income was $69,021–6% higher than the $65,292 needed to afford the typical home.

“For over a decade, America has been slowly marching toward a housing affordability crisis due to chronic underbuilding, and that crisis was kicked into overdrive when the pandemic homebuying boom fueled a meteoric rise in housing prices,” said Redfin Senior Economist Elijah de la Campa. “Now there’s another culprit squeezing homebuyers: elevated mortgage rates. We’re slowly climbing our way out of an affordability hole, but we have a long way to go. Rates have come down from their peak, and are expected to fall again by the end of the year, which should make homebuying a little more affordable and incentivize buyers to come off the sidelines.”

Home sales fell to the lowest level in roughly three decades last year as elevated mortgage rates pushed homeownership out of reach for many Americans–especially first-time buyers, who haven’t built up equity from the sale of a previous home. Many Americans remain priced out of homeownership because rates remain elevated, and home prices continue climbing (they rose 7% year over year in February) due to a shortage of homes for sale.

Housing Affordability Remains Near Historic Lows as Housing Costs Grow Twice as Fast as Incomes

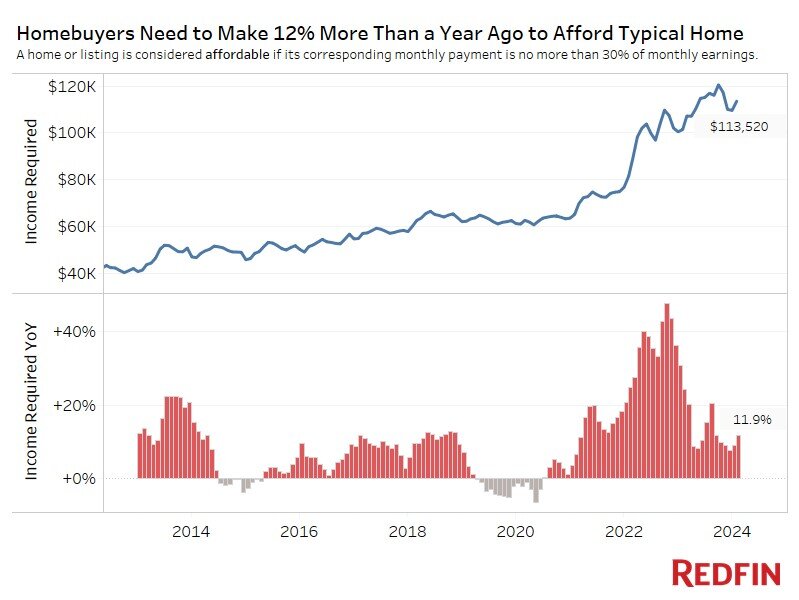

The $113,520 income needed to afford the median priced home in February 2024 was up 12% from a year earlier–the biggest annual gain since August–and still wasn’t far below October’s all-time high. It was up 39% from February 2022 and up 74% from February 2021, when mortgage rates were near their all-time low of 2.65%.

Affordability is strained today because housing costs are rising much faster than incomes. The median household income has increased 6% over the last year, half as much as the income needed to afford the median-priced home.

The median monthly housing payment for homebuyers was $2,838 in February, down from a record high of $3,012 in October but up 12% year over year.

Metros with smallest increases in income needed to afford a home

In San Antonio, homebuyers in February needed to earn 1% more than a year earlier to afford the typical home–the smallest increase among the metros Redfin analyzed. Next came Detroit (3%), Austin, TX (4%), Fort Worth, TX (5%) and San Francisco (6%).

Home prices in Texas are soft, which is why many metros in the Lone Star State are seeing relatively small gains in the income needed to afford a home. The median home sale price in San Antonio fell 4% year over year in February, making it the only major metro that posted a decline. And prices in Fort Worth and Austin were up by less than 1%, making them some of the smallest gainers in the nation.

Texas has been building more homes than any other state, which has put downward pressure on prices because it means homebuyers have more options to choose from. Housing supply in Fort Worth jumped 14% year over year in February, one of the biggest increases in the U.S. In Austin, the housing market has also lost steam because an influx of out-of-towners in recent years drove housing costs to unsustainable heights, leaving many buyers priced out.

Metros with largest increases in income needed to afford a home

In Anaheim, CA, homebuyers in February needed to earn 20% more than a year earlier to afford the typical home–the biggest jump in the nation. Next came West Palm Beach, FL (18%), Fort Lauderdale, FL (18%), New Brunswick, NJ (18%) and San Diego (17%).

These metros have seen some of the biggest jumps in home prices, which is driving up the income needed to afford a home. Anaheim, the third most expensive homebuying market in the country, saw its median sale price surge 16% year over year in February–the second largest increase in the nation. West Palm Beach and Fort Lauderdale ranked third and fourth, both posting price increases of 13%.

There are 13 major metros where homebuyers can afford the typical home while making less than six figures

In Detroit, the typical household needed to earn $46,168 to afford the median priced home in February, making it the most affordable market in the country. It was followed by Cleveland ($58,186), Pittsburgh ($61,603), St. Louis ($66,755) and Philadelphia ($73,182). The other metros where homebuyers making less than $100,000 can afford the typical home are: Indianapolis, Warren, MI, Cincinnati, Milwaukee, Kansas City, MO, Virginia Beach, VA, San Antonio and Columbus, OH.

There are 11 major metros where homebuyers make more than they need to afford a home

The typical Detroit household earns $64,018, or 39% more than the $46,168 needed to afford the $165,000 median priced home. Next comes Pittsburgh, where the typical household earns 30% more than it needs to afford a home, followed by Cleveland (29%), St. Louis (29%) and Warren (21%). The other metros where the typical household earns more than it needs to afford a home are: Indianapolis (11%), Cincinnati (20%), Baltimore (9%), Milwaukee (5%), Kansas City (4%) and Minneapolis (4%).

There are seven metros where the typical household earns over 50% less than it needs to afford a home

In Los Angeles, the typical household earns $93,315, or 60% less than the $236,079 needed to afford the $874,800 median priced home. The other metros where the typical household earns over 50% less than needed to afford a home are: Anaheim (58% less), San Francisco (58%), San Jose, CA (55%), San Diego (55%), New York (52%) and Miami (51%).