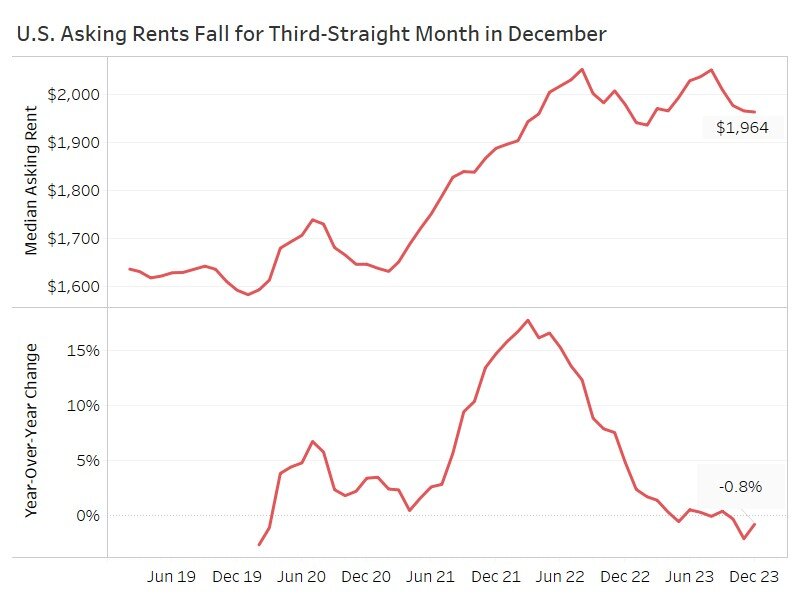

According to property broker Redfin, the median U.S. asking rent fell 0.8% year over year in December to $1,964. That’s the third consecutive decline, following a 2.1% annual drop in November 2023 — which was the largest since 2020 — and a 0.3% dip in October. December rents were little changed from the prior month (-0.2%).

The rental market has lost steam largely due to a jump in supply fueled by a building boom in recent years. That has left many landlords struggling to fill vacancies, motivating some of them to drop asking rents. Some landlords are also offering one-time concessions like a free month’s rent or reduced parking costs to attract renters. This means the prices renters are paying in total are likely coming down faster than they appear to be in the data.

Other reasons rents have cooled include economic uncertainty, slowing household formation, and affordability challenges, as rents are still only 4.4% below their record high. Additionally, there are new signs that the economy is slowing; Americans are starting to tighten their belts, which could be contributing to the decline in rents.

“High supply–more so than low demand–is driving rent declines. But if mortgage rates continue to drop at a fast clip in 2024, slowing rental demand could become a major driver of rent declines,” said Redfin Economics Research Lead Chen Zhao. “That’s because more Americans would ditch the rental market to become homeowners, leaving landlords with even more vacancies.”

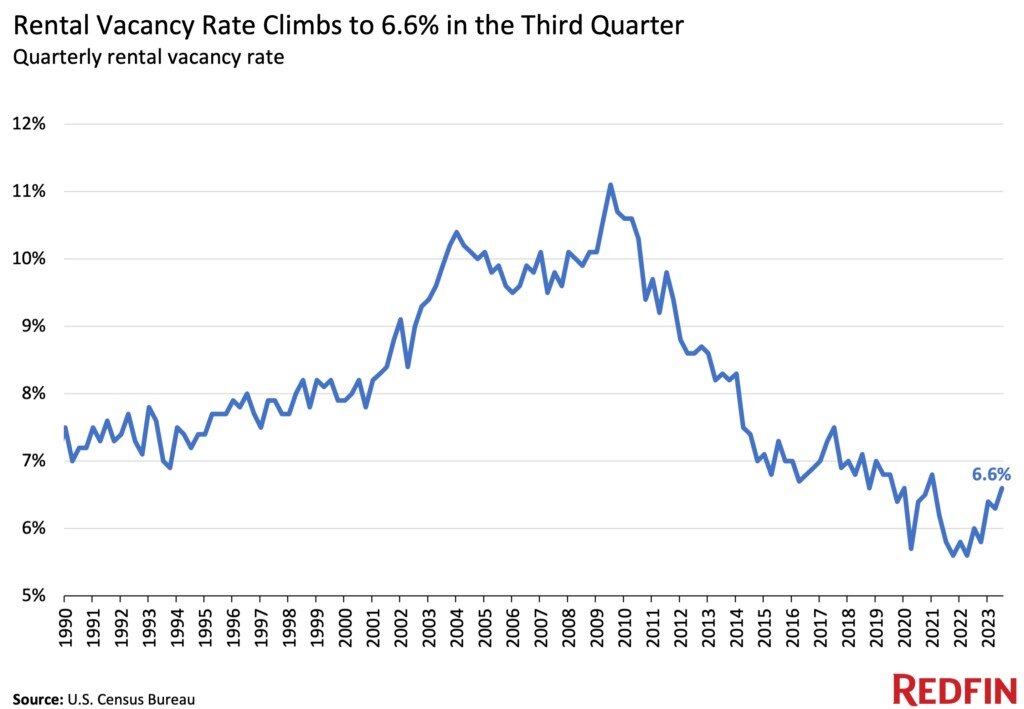

There are more newly built and under-construction apartments in the U.S. than there were a year ago; the number of completed apartments is near the highest level in more than 30 years, and the number under construction is just shy of its record high.

Because renters have an increasing number of buildings to choose from, vacancies have climbed. The rental vacancy rate rose to 6.6% in the third quarter–the most recent period for which data is available–the highest level since the first quarter of 2021.

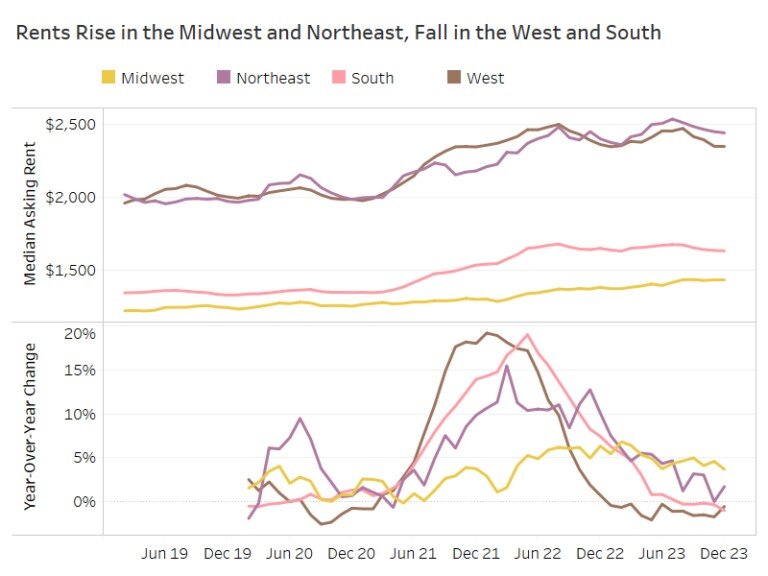

Rents Rise in the Midwest and Northeast, Fall in the West and South

The median asking rent in the Midwest rose 3.7% year over year to $1,434. Rents also rose in the Northeast, climbing 1.7% to $2,439. Meanwhile, rents fell 1% year over year to $1,632 in the South, and declined 0.6% to $2,346 in the West.

Rents are likely holding up best in the Midwest and Northeast because those regions haven’t been building as much as the South and West, meaning some landlords have less incentive to drop prices because they’re not dealing with as many vacancies.

“With rents falling and vacancies rising, now is a good time to shop around or try to renegotiate your rent if your lease is up–especially if you’re a renter in the South or West,” Zhao said.