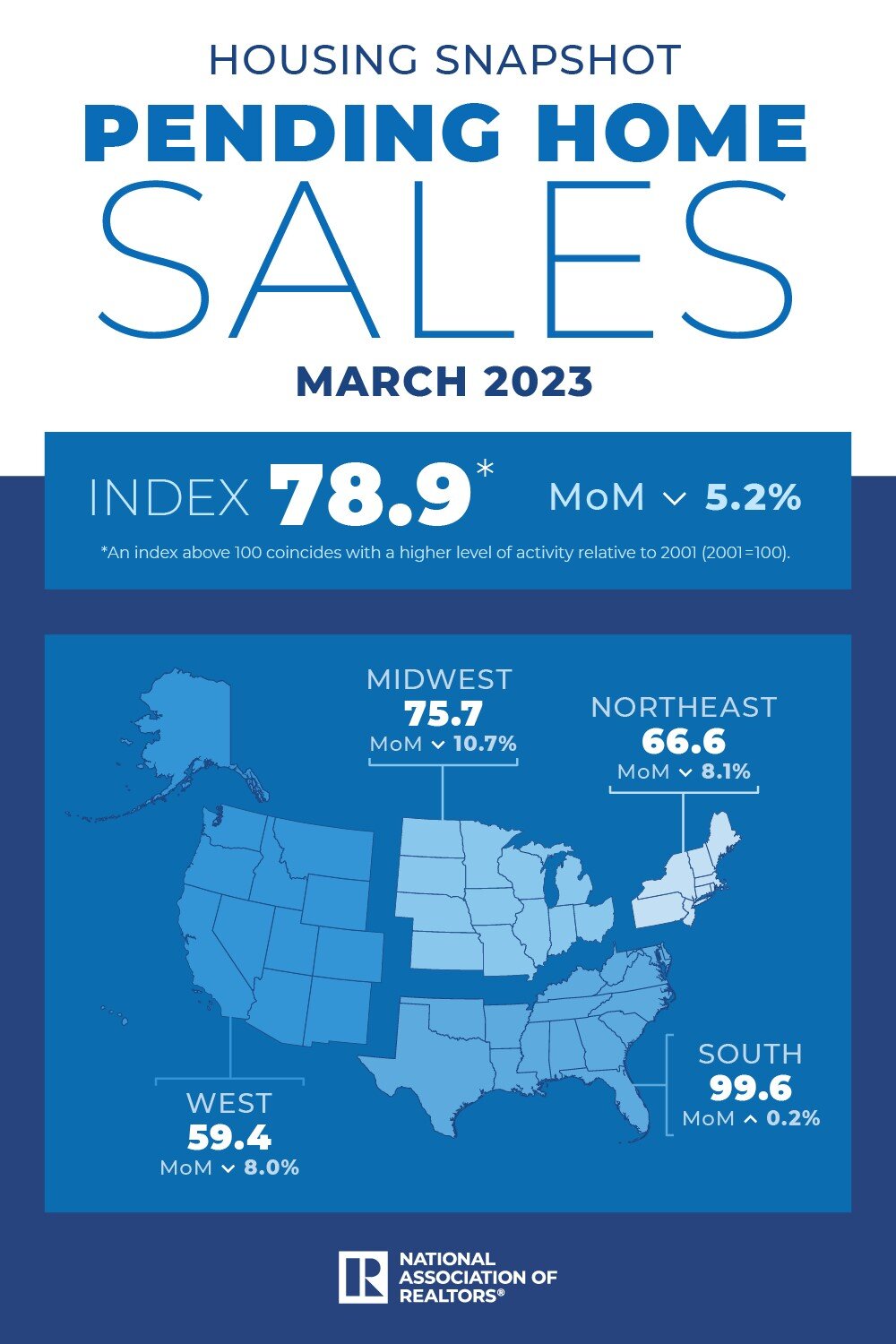

According to the National Association of Realtors, pending home sales decreased in March 2023 for the first time since November 2022. Three U.S. regions posted monthly losses, while the South increased. All four regions saw year-over-year declines in home sales transactions.

The Pending Home Sales Index (PHSI) – a forward-looking indicator of home sales based on contract signings – waned by 5.2% to 78.9 in March. Year over year, pending transactions dropped by 23.2%. An index of 100 is equal to the level of contract activity in 2001.

“The lack of housing inventory is a major constraint to rising sales,” said NAR Chief Economist Lawrence Yun. “Multiple offers are still occurring on about a third of all listings, and 28% of homes are selling above list price. Limited housing supply is simply not meeting demand nationally.”

NAR forecasts that the economy will continue adding jobs, albeit at a slower pace, and mortgage rates will drop – with the 30-year fixed mortgage rate progressively falling to 6.0% this year and to 5.6% in 2024. Housing starts will fall from last year by 7.3% in 2023, to 1.44 million, and then increase 6.9% in 2024, to 1.54 million.

“Sales in the second half of the year should be notably better than the first half as job gains continue and more favorable mortgage rates are expected,” said Yun. “Sales of new homes are already matching 2019 pre-COVID activity and are expected to increase in 2023, largely due to plentiful inventory in this segment of the market.”

With continued job gains and improving interest rates, NAR anticipates existing-home sales will steadily improve in the upcoming months but will still come up short on an annual figure. Existing home sales will drop from the prior year by 9.3% in 2023, to 4.56 million, before increasing by 15.4% in 2024, to 5.26 million. Newly constructed home sales will increase from last year by 4.5% in 2023, to 670,000, due to more plentiful inventory in this segment of the market, and increase by another 11.9% in 2024, to 750,000.

Compared to last year, NAR forecasts that median existing-home prices will mostly stabilize – with the national median existing-home price decreasing by 1.8% in 2023, to $379,600, and then improving by 2.8% in 2024, to $390,000. The expensive West region of the U.S. will see lower prices, but the affordable Midwest region will likely squeak out a positive gain. The median new home price will be lower by 1.9% in 2023, to $449,100, followed by an improvement of 4.2% in 2024, to $468,000.

Pending Home Sales Regional Breakdown

The Northeast PHSI fell 8.1% from last month to 66.6, a decline of 24.3% from March 2022. The Midwest index dropped 10.7% to 75.7 in March, down 21.5% from one year ago.

The South PHSI improved 0.2% to 99.6 in March, falling 19.8% from the prior year. The West index decreased 8.0% in March to 59.4, reducing 32.2% from March 2022.