According to a new report from CBRE, lab vacancies increased across the top 13 U.S. life sciences markets in the first quarter of 2023, providing relief for companies that had found little available space in recent years.

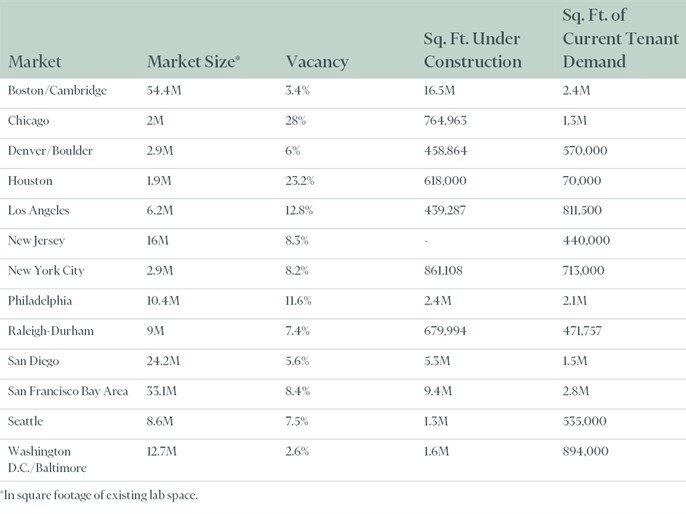

Average vacancy of 6.7% in the first quarter marked an increase of 170 basis points from a year earlier. That compares to an average of 7.7% in the first quarter of 2020, before the pandemic sparked a wave of activity in the life sciences sector. The low point for vacancy – 4.6% – came in the second quarter of 2022.

Other measures differed in the first quarter, indicating a sector cooling to red hot from white hot. Despite announcements of layoffs, U.S. life sciences employment increased by 3.5% in February from a year earlier, exceeding the overall job-growth rate of 2.9%. Average rental rates increased by 3.2% from the fourth quarter to a record $65.62 per sq. ft. in the first.

Meanwhile, venture capital funding for life sciences companies declined in the first quarter from the fourth amid banking sector turmoil, which constrained capital availability for the tech and life sciences industries. Venture capital investment in life sciences now is on-par with 2019 levels.

Developers had more than 40 million sq. ft. of lab space under construction in the 13 markets in the first quarter, with 25% of it preleased.

“Most measures of the life sciences market remain at or above pre-pandemic levels, demonstrating that this is a market buttressed by demand,” said Matt Gardner, CBRE Americas Life Sciences Leader. “There is a lot of promising science in the pipeline, and the sector likely will regain momentum once the lending market recovers. Meanwhile, companies of all sizes are likely to find at least a few available spaces in markets where there previously was little or no such availability.”