According to JLL’s latest Hong Kong Property Market Monitor Report, Hong Kong’s Grade A office market is mainly driven by upgrading demand following more new office completions this year.

The market sentiment continued to improve amid the border reopening and economic recovery. Among a handful of new lettings, Doo Group leased an entire floor with a gross floor area of 12,600 sq ft at The Millennity in Kwun Tong to upgrade and consolidate its offices within the same district.

Alex Barnes, Managing Director at JLL in Hong Kong said, “There will be around 3.2 million sq ft of new Grade A office space scheduled for completion this year which would inevitably drive the vacancy rate up, however, the new completions are attracting tenants to relocate and upgrade their offices. Tenants are viewing it as an opportune time to upgrade on the back of more choices, variety of floor plate sizes, and the latest green and technological facilities.”

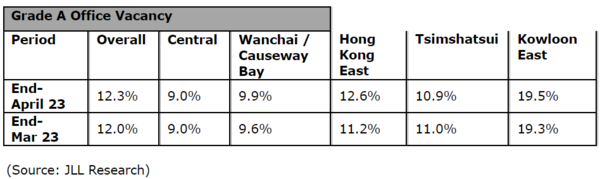

The overall office market recorded a negative net absorption of 245,100 sq ft in April, due to the return of some sizable spaces to the market during the month. The overall vacancy rate rose marginally to 12.3% at the end of April, with Central’s vacancy rate remaining flat.

Overall net effective rents dropped by 0.3% m-o-m in April. Among the major office submarkets, rentals in Central and Kowloon East dropped by 0.5%, while Tsimshatsui’s rent rose marginally by 0.3%.

In terms of the retail market, Cathie Chung, Senior Director of Research at JLL also commented, “Retail leasing activities accelerated in high streets in core locations following the return of tourists, with committed leases mostly on the standard two- to three-year terms, compared to the short-term leases prevalent during COVID, and the strengthening leasing market has helped to improve the retail investment market sentiment.”