According to the National Association of Realtors, U.S. pending home sales slid for the sixth consecutive month in November 2022. All four U.S. regions recorded month-over-month decreases, and all four regions saw year-over-year declines in transactions.

“Pending home sales recorded the second-lowest monthly reading in 20 years as interest rates, which climbed at one of the fastest paces on record this year, drastically cut into the number of contract signings to buy a home,” said NAR Chief Economist Lawrence Yun. “Falling home sales and construction have hurt broader economic activity.”

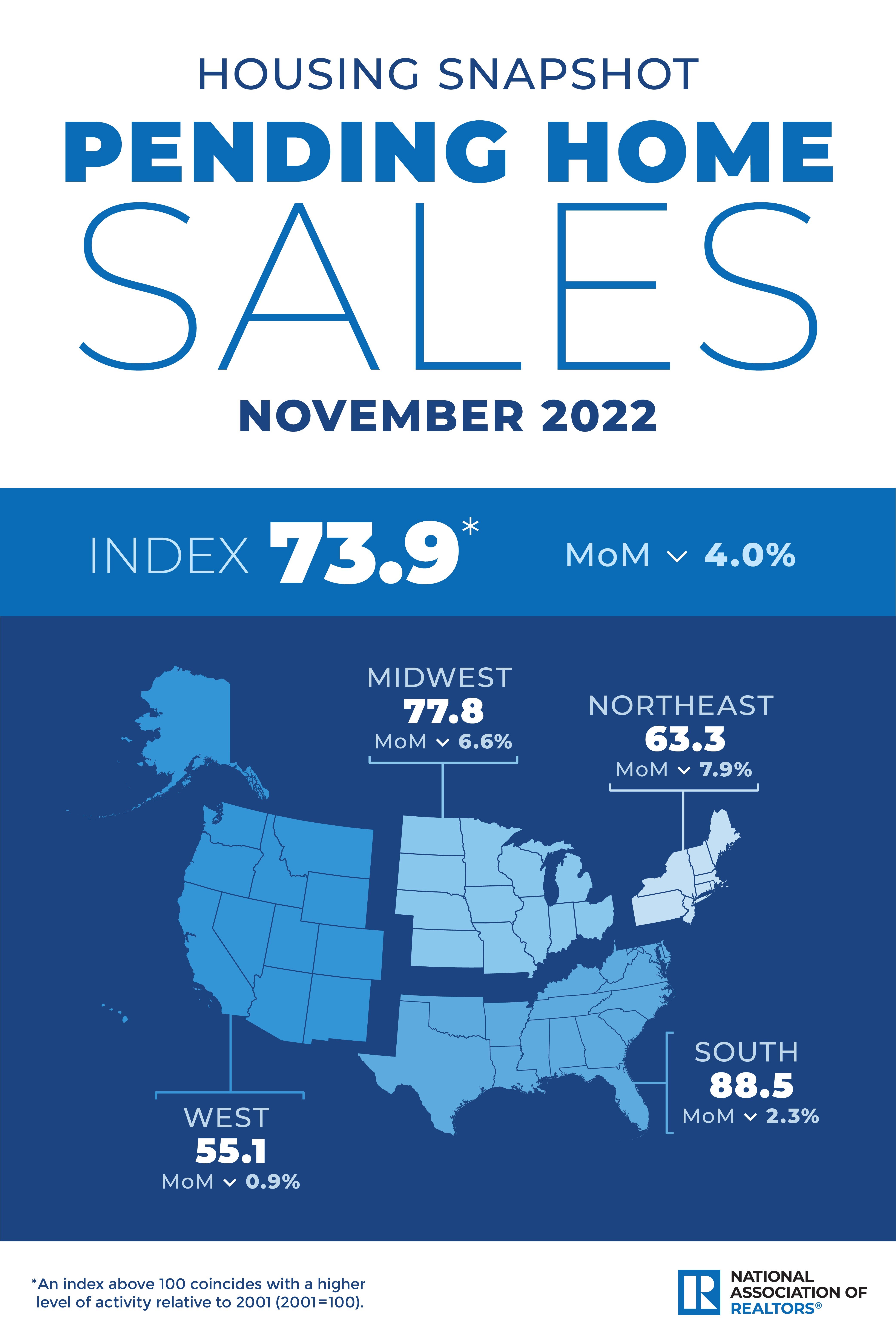

The Pending Home Sales Index — a forward-looking indicator of home sales based on contract signings — fell 4.0% to 73.9 in November. Year-over-year, pending transactions dropped by 37.8%. An index of 100 is equal to the level of contract activity in 2001.

“The residential investment component of GDP has fallen for six straight quarters,” Yun added. “There are approximately two months of lag time between mortgage rates and home sales. With mortgage rates falling throughout December, home-buying activity should inevitably rebound in the coming months and help economic growth.”

Pending Home Sales Regional Breakdown

The Northeast PHSI slipped 7.9% from last month to 63.3, a drop of 34.9% from November 2021. The Midwest index decreased 6.6% to 77.8 in November, a fall of 31.6% from one year ago.

The South PHSI retracted 2.3% to 88.5 in November, fading 38.5% from the prior year. The West index dropped by 0.9% in November to 55.1, retreating 45.7% from November 2021.

“The Midwest region — with relatively affordable home prices — has held up better, while the unaffordable West region suffered the largest decline in activity,” Yun said.